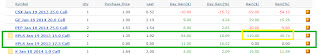

Today's move down nearly 2% on light volume is consistent with the pattern that we identified a few days ago. An interesting note is that in the past few days, even as the stock was going up in value the PUT was having slight increases! Meaning that even as the stock went up, sentiment (and investors money) was voting against the gains.

As you can see in the chart the pattern is repeating for the 4th time. Keep your eye on it. This stock is in a fairly shallow trading range and things can change quickly when that happens. Fortunately we can all rest assured that if the stock moves anywhere it is not going to be on performance data. Instead expect it to move down ward gradually.

My Nokia position is a Jan 2014 PUT option with a $5 strike. Because this is a pretty shallow trade without a ton of price movement, I will likely keep this option waiting for a dip in the $4 range. I know a lot of people think that the new $50 Nokia Windows based phone is going to create a buzz. I don't see it happening. Until Nokia or Windows are able to show they have any competence in the smart phone market I will assume the numbers will come in below expectations. Just look at the financials. Not Pretty.

So stick around for a move down to $4 in the LONG run. short term I'm expecting a bottom around $4.90 to $4.95 or about $.40 below current trading. Options usually trade heavily on momentum, if I can get 3 or 4 days in a row of negative momentum I'm likely to make a 20-30% gain on the put option.

Thanks for reading!

Straight from the Chart

Disclaimer:

Just to be clear, nothing that I'm posting on this blog is in any way advice that should be followed by anyone else. All investment decisions should be made carefully by all individuals taking into account their own financial situation and appropriate levels of risk. Do not take anything I say for anything more than it is, opinion, speculation, and woefully undereducated guesses as to how I think a few stocks are going to perform.

Just to be clear, nothing that I'm posting on this blog is in any way advice that should be followed by anyone else. All investment decisions should be made carefully by all individuals taking into account their own financial situation and appropriate levels of risk. Do not take anything I say for anything more than it is, opinion, speculation, and woefully undereducated guesses as to how I think a few stocks are going to perform.