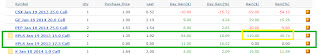

So I started this experiment with only $1000 so my dollar numbers are small. Don't look at the dollar amount ($110 Profit) but instead look at the percentage. As of today I have a 41% gain in the SPLS Jan 2013 option with a $15 strike. This option got cut in half on the 10% decline in stock price when the Q4 results were announced creating a terrific buying opportunity. It has bounced right back to where it was before the dip. But don't go anywhere yet. There is more to come for SPLS.

Staples (SPLS) raised its quarterly dividend by 10%. In the land of performance signaling raising the dividend usually means that management is confident in continued growth. Ignoring the crazy sell off that we took advantage of the other day, this stock has been showing an upward trend and higher lows since October. This stock has a 52 week high around $21. I don't know about $21, but I am calling that the long term outlook is a $19 target price. With the recent sell off on huge volume, I think most of the profit taking is out of the stock, clearing the way for a continued rally.

Disclaimer:

Just to be clear, nothing that I'm posting on this blog is in any way advice that should be followed by anyone else. All investment decisions should be made carefully by all individuals taking into account their own financial situation and appropriate levels of risk. Do not take anything I say for anything more than it is, opinion, speculation, and woefully undereducated guesses as to how I think a few stocks are going to perform.

No comments:

Post a Comment

Thanks so much for your comment! Straight from the Chart is open to everyone's thoughts and opinions and hope you come back to share yours again and again!

Thanks for reading!

Straight from the Chart!