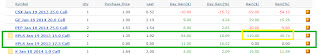

Monster has been on a huge losing streak the past 2 months. I spotted the channel at an opportune moment when the stock was just cresting on the upper resistance level. Purchased a $55 put option with a Dec 2012 expiration date. The stock was above $60 when I bought and has crawled down to $56 this morning.

With such a short execution period I decided to take profits on this one early. I still believe this stock has a long way to go down and will probably be below $40 before this losing streak is over. But the number 1 rule in investing and one of my favorite Jim Cramer quotes "Bulls make money, Bears make money, Pigs get slaughtered." Don't. get. greedy.

Keeping an eye on MNST in the next few days could provide an inflection point. There is some support around the $53 level in the long term trends. The channel is strong enough that it may blow right through it and keep heading down, if it does I may get in on another put to get in for a long ride down.

I'm trading such small amounts of money that the broker fees take a chunk out of my gains. What I bought for $420 cause me an extra $10 in fees and sold for $500 another $10. Losing $20 in profit on a $80 trade is no small thing and took my net gains to 13% on this trade after fees.

20% Gross and 13% Net on a trade that lasted 8 Days!!! That is not a bad trade. Risky, yes, but profitable. My portfolio is on a big winning streak since jumping back in after my summer hiatus. On track to beat all major indexes for the year.

Thanks for reading!

Straight from the Chart

Disclaimer:

Just to be clear, nothing that I'm posting on this blog is in any way advice that should be followed by anyone else. All investment decisions should be made carefully by all individuals taking into account their own financial situation and appropriate levels of risk. Do not take anything I say for anything more than it is, opinion, speculation, and woefully undereducated guesses as to how I think a few stocks are going to perform.