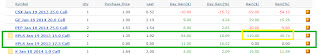

So I've been losing my shirt on CSX. After a recent dip I thought the company was ready for a rally. Thus far I've been wrong. Thankfully my position is relatively small compared to my major holdings, SPLS in particular. BUT, today is an important day and this week is going to be a big one for the performance of CSX. I've ridden this one down to its support level right here at $20.

With a double bottom forming here at $20 we are going to see some action off of this price. If it falls below there are no support levels forming for about another 10% below $20. I am still holding my breath for a bounce off of the support level which is why I haven't sold yet. But I will be watching it very closely for the next few days. A day or two below $20 and it will be time to cut and run as it may run all the way down.

Important note about trading options. Notice that I am experiencing a 50% decline on a 10% decline on stock price. If you are going to be trading options you have to be able to take the swings and you must diversify. The only good news is that a week or two in the other direction and 10% can double the options price. For me and the $1000 I'm starting with the risk is worth while, and thus far it has been profitable.

Thanks for reading!

Straight form the Chart

Thanks for reading!

Straight form the Chart

Disclaimer:

Just to be clear, nothing that I'm posting on this blog is in any way advice that should be followed by anyone else. All investment decisions should be made carefully by all individuals taking into account their own financial situation and appropriate levels of risk. Do not take anything I say for anything more than it is, opinion, speculation, and woefully undereducated guesses as to how I think a few stocks are going to perform.

Just to be clear, nothing that I'm posting on this blog is in any way advice that should be followed by anyone else. All investment decisions should be made carefully by all individuals taking into account their own financial situation and appropriate levels of risk. Do not take anything I say for anything more than it is, opinion, speculation, and woefully undereducated guesses as to how I think a few stocks are going to perform.